Biomass Carbonization and Carbon Credit Trading: Unlocking Additional Revenue Streams for Solid Waste Resources

As the world grapples with the escalating issue of waste management and climate change, innovative solutions are becoming essential. Biomass carbonization, a process that turns organic waste into valuable biochar, is gaining traction as a sustainable method for managing solid waste. Paired with carbon credit trading, this technique can create new economic opportunities while addressing environmental challenges. In this article, we’ll explore how biomass carbonization combined with carbon credit trading can unlock additional revenue streams for solid waste resources and contribute to a more sustainable future.

1. What is Biomass Carbonization?

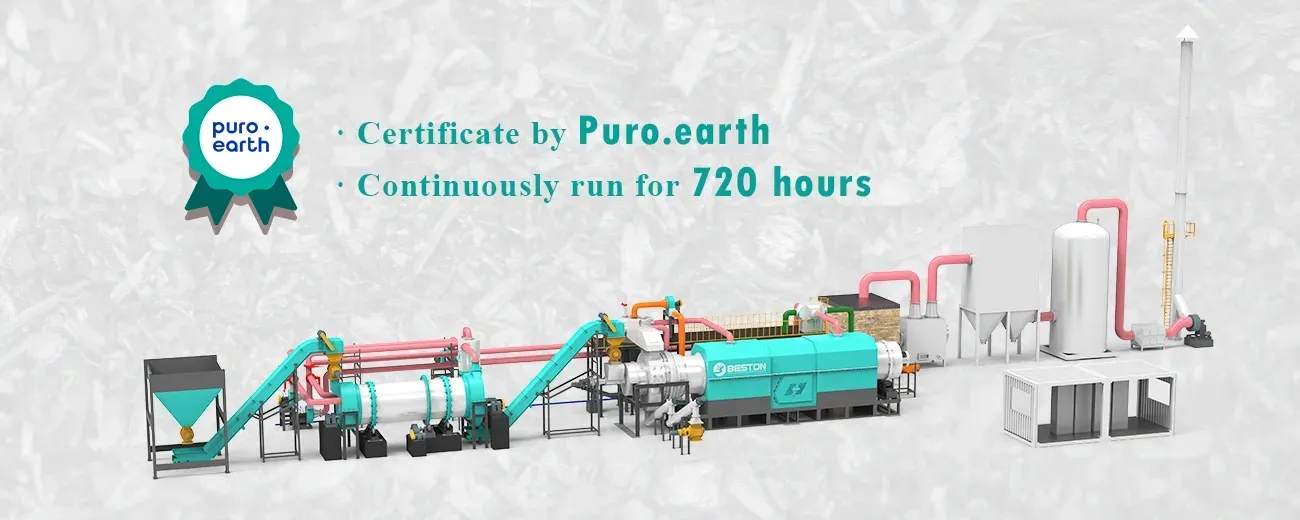

- Biomass Carbonization refers to the process of converting organic waste (such as agricultural residues, forestry by-products, and municipal solid waste) into biochar through pyrolysis. This is done in the absence of oxygen, using high heat to break down the organic material into carbon-rich products. Biochar production equipment is the key solution.

- Biochar, a stable form of carbon, has a variety of uses, including soil enhancement, water filtration, and carbon sequestration.

2. How Biomass Carbonization Contributes to Waste Management

- Waste-to-Value: Biomass carbonization offers an effective way to handle organic waste, diverting it from landfills and reducing methane emissions. Instead of accumulating in landfills, organic waste is transformed into a high-value product (biochar), which can be used for agricultural or industrial purposes.

- Sustainable Agricultural Practice: The biochar produced from biomass carbonization can be used to improve soil quality, enhance water retention, and increase crop yield. This makes it a valuable resource for farmers and agricultural industries, creating a market for the by-products of waste management.

- Energy Production: During the carbonization process, energy is released in the form of syngas (synthesized gas), which can be captured and used for generating electricity or heat, further increasing the economic viability of biomass carbonization.

3. What is Carbon Credit Trading?

- Carbon Credit Trading is a system where companies or organizations that reduce greenhouse gas emissions can sell carbon credits to other entities that are unable to meet their own emission reduction targets.

- One carbon credit represents the reduction of one metric ton of CO₂ or its equivalent in other greenhouse gases.

- Carbon offset projects, like biomass carbonization, can generate carbon credits because biochar sequestration locks away carbon in the soil for hundreds to thousands of years, preventing it from entering the atmosphere.

4. How Biomass Carbonization Generates Carbon Credits

- Carbon Sequestration: Biochar, once created, is highly stable and can store carbon for long periods, preventing the release of CO₂ into the atmosphere. This process qualifies as a carbon offset, allowing businesses involved in biomass carbonization to earn carbon credits for their efforts in reducing global warming potential.

- Certification of Carbon Credits: To participate in carbon credit trading, carbon sequestration projects must undergo a certification process with a recognized carbon standard (e.g., Verra, Gold Standard). These certifications ensure that the carbon offset is real, measurable, and permanent.

5. Unlocking Additional Revenue Streams through Carbon Credit Trading

- Revenue from Carbon Credits: By engaging in biomass carbonization and generating biochar, companies can earn carbon credits, which can then be sold on carbon credit exchanges. The price of carbon credits can vary depending on market demand and supply, but it provides an additional revenue stream for waste management or biomass businesses.

- Attracting Investment: The integration of carbon credit trading can make biomass carbonization projects more attractive to investors. By proving that their operations not only manage waste but also provide measurable climate benefits, companies can access funding and partnerships that might otherwise be unavailable.

- Encouraging Sustainable Practices: Carbon credit trading also incentivizes companies to adopt more sustainable practices. The ability to sell carbon credits for their emissions reductions creates a financial motive to further reduce environmental impacts, thus supporting the global transition to a low-carbon economy.

6. Real-World Examples and Case Studies

- Biochar for Soil Enhancement: Some agricultural companies in developing countries have partnered with waste management firms to produce biochar, which is then used to improve soil health. These companies have not only reduced the amount of waste going to landfills but have also earned significant revenue from carbon credits.

- Corporate Sustainability Projects: Large corporations with high carbon footprints are increasingly turning to carbon credit trading to meet their sustainability goals. Companies in sectors like agriculture, forestry, and energy are leveraging biomass carbonization as a tool for carbon offsetting, allowing them to reduce their emissions while contributing to waste resource management.

Conclusion:

Biomass carbonization and carbon credit trading represent a powerful combination of waste management and climate action. By converting organic waste into biochar and participating in the carbon credit market, businesses can not only manage waste more sustainably but also unlock new revenue streams. With the growing demand for carbon offset projects and the economic potential of carbon credits, biomass carbonization is poised to play a significant role in the global transition to a low-carbon economy.