Investment Cost Analysis of Mobile Biochar Machine

In the ever-evolving realm of sustainable technology, the mobile biochar machine stands as a beacon of innovation, promising not just environmental benefits but also a strategic investment opportunity. This article delves into a comprehensive investment cost analysis of the mobile biochar machine, unraveling the financial intricacies that define its viability.

Understanding the Technological Marvel: A Brief Overview

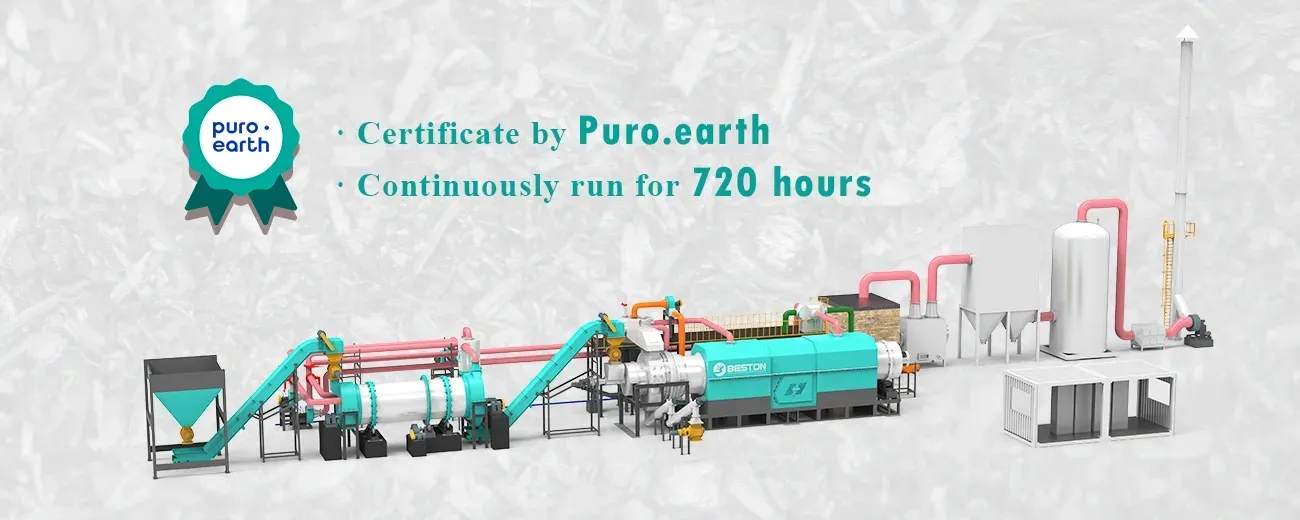

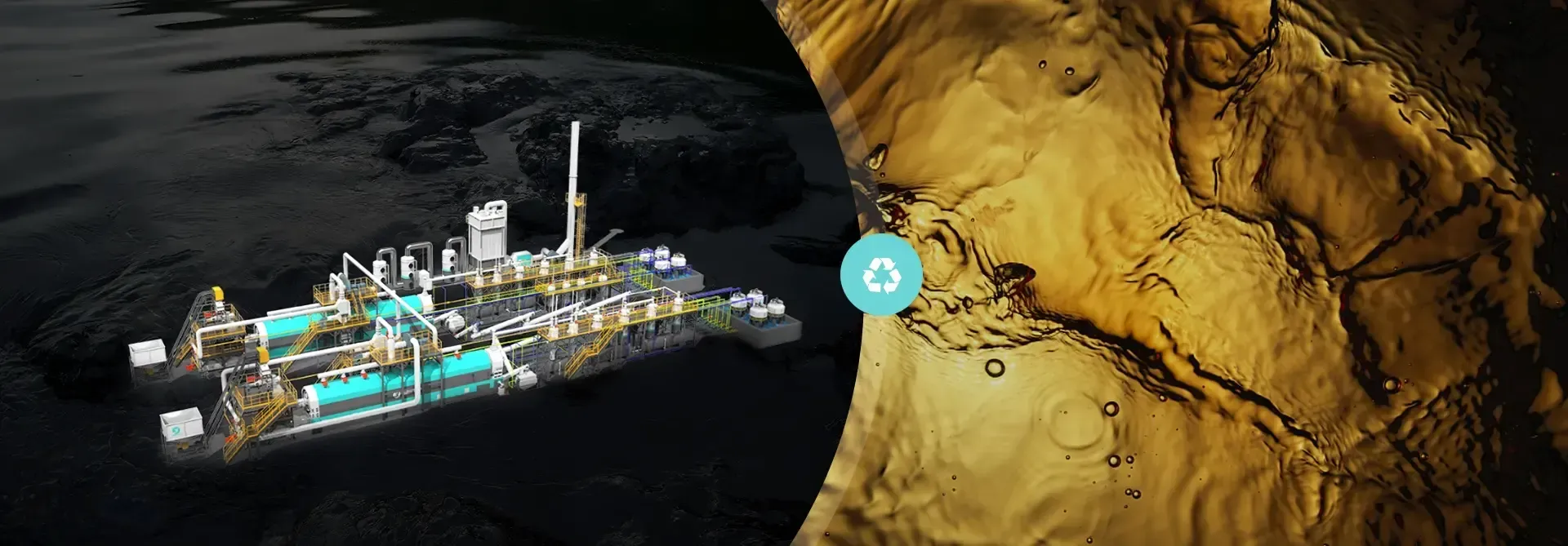

Before we plunge into the financial dimensions, a cursory understanding of the mobile biochar machine is imperative. This portable marvel embodies the principles of pyrolysis, converting organic biomass into biochar, a valuable soil amendment. Its mobility adds a layer of versatility, enabling on-site utilization and minimizing logistical challenges.

The Investment Landscape: Key Financial Considerations

1. Capital Expenditure (CapEx): Setting the Stage

The journey begins with the upfront investment required to acquire the mobile biochar machine. This includes the cost of the machinery itself, auxiliary equipment, and initial setup expenses. The mobile biochar machine, being a compact and versatile solution, often presents a more reasonable CapEx compared to larger, stationary alternatives.

2. Operational Costs: Sustaining Efficiency

Beyond the initial investment, operational costs play a pivotal role in the financial equation. These encompass expenses related to feedstock, energy consumption, maintenance, and labor. The mobile nature of the biochar machine introduces flexibility, allowing operators to optimize operational costs based on site-specific factors.

3. Output Capacity and Revenue Generation: Balancing the Equation

The financial viability of any investment hinges on its revenue-generating potential. The mobile biochar machine, with its capacity to produce biochar on the go, taps into diverse markets. Biochar itself serves as a valuable commodity in agriculture and environmental applications, contributing to a potentially lucrative revenue stream.

Case Studies: Realizing Returns on Investment

1. Agricultural Sector Integration: Cultivating Profits

In agricultural settings, the mobile biochar machine finds its niche. Farmers embracing biochar witness improvements in soil fertility and crop yield. The financial returns emanate not only from biochar sales but also from the tangible enhancements in agricultural productivity.

2. Waste Management Ventures: Transforming Challenges into Opportunities

Entrepreneurs venturing into waste management discover a dual benefit – addressing organic waste challenges and generating revenue through biochar production. The mobile biochar machine, with its adaptability, aligns seamlessly with such endeavors, showcasing a compelling return on investment.

Financial Prudence: Risk Mitigation and Long-Term Gains

1. Risk Mitigation Strategies: Navigating Uncertainties

Investments come with inherent risks, and the mobile biochar pyrolysis equipment landscape is no exception. Implementing risk mitigation strategies involves assessing market dynamics, regulatory changes, and technological advancements. Diversification and strategic partnerships emerge as prudent approaches to safeguard investments.

2. Long-Term Gains and Sustainability: Future-Proofing Investments

The mobile biochar machine, positioned at the intersection of sustainability and technology, presents an opportunity for long-term gains. As societies emphasize eco-friendly practices and governments incentivize sustainable initiatives, investments in technologies like the mobile biochar machine align with the trajectory of future demands.

Conclusion: Navigating the Investment Terrain

In conclusion, the investment cost analysis of the mobile biochar machine reveals a multifaceted landscape where environmental stewardship converges with financial prudence. The strategic deployment of this technology, coupled with astute financial management, positions investors to not only contribute to sustainable practices but also reap the rewards of a forward-thinking investment.