Evaluating the Investment Potential of a Coconut Shell Charcoal Making Machine

The growing emphasis on sustainable practices and renewable resources has highlighted the investment potential of coconut shell charcoal making machines. These machines convert coconut shells, a byproduct of coconut processing, into high-value charcoal. This article explores the investment potential of coconut shell charcoal making machine, analyzing their financial viability, market opportunities, and operational advantages.

Market Demand and Opportunities

Rising Demand for Charcoal

Charcoal made from coconut shells has seen increasing demand in various sectors, including energy, metallurgy, and agriculture. The global shift towards eco-friendly alternatives to traditional charcoal and fossil fuels is driving this trend. Coconut shell charcoal is renowned for its high calorific value, low ash content, and minimal smoke emission, making it an attractive choice for consumers and industries alike.

Expanding Applications

The versatility of coconut shell charcoal extends to diverse applications. In the energy sector, it is used as a clean fuel source for heating and power generation. In metallurgy, it serves as a reducing agent in the production of high-quality metals. Additionally, its application in agriculture as a soil conditioner and in water filtration underscores its broad utility, further enhancing its market appeal.

Economic Advantages

Cost-Effectiveness

Investing in a coconut shell charcoal making machine can be economically advantageous due to several factors:

- Low Raw Material Costs: Coconut shells are an abundant byproduct of coconut processing and are often available at minimal cost. This low-cost feedstock contributes to the overall affordability of production.

- Efficient Production Process: Modern charcoal making machines are designed for efficiency, optimizing the conversion process and reducing operational costs. Advanced technologies, such as continuous pyrolysis systems, enhance productivity and minimize waste.

High Return on Investment

The potential for high returns on investment (ROI) is a significant draw for investors. By producing high-quality charcoal from coconut shells, businesses can benefit from:

- Premium Pricing: The high demand for eco-friendly and high-performance charcoal allows for premium pricing in the market. This price premium can significantly increase profit margins.

- Scalability: The scalability of coconut shell charcoal production enables investors to expand operations and increase output as demand grows. This flexibility supports long-term growth and profitability.

Environmental Impact

Sustainability Benefits

Coconut shell charcoal manufacturing equipment contributes to environmental sustainability in multiple ways:

- Utilization of Waste: The process transforms coconut shells, which would otherwise be discarded or burned inefficiently, into valuable products. This waste-to-resource approach reduces environmental pollution and promotes resource efficiency.

- Reduced Carbon Footprint: Compared to traditional charcoal production methods, which often involve deforestation and high emissions, coconut shell charcoal production is more environmentally friendly. The use of agricultural byproducts minimizes the need for additional raw materials and reduces carbon emissions.

Compliance with Regulations

The growing focus on environmental regulations and standards enhances the appeal of investing in coconut shell charcoal making machines. These machines often meet stringent environmental requirements, making them suitable for markets with strict sustainability mandates.

Technological Advancements

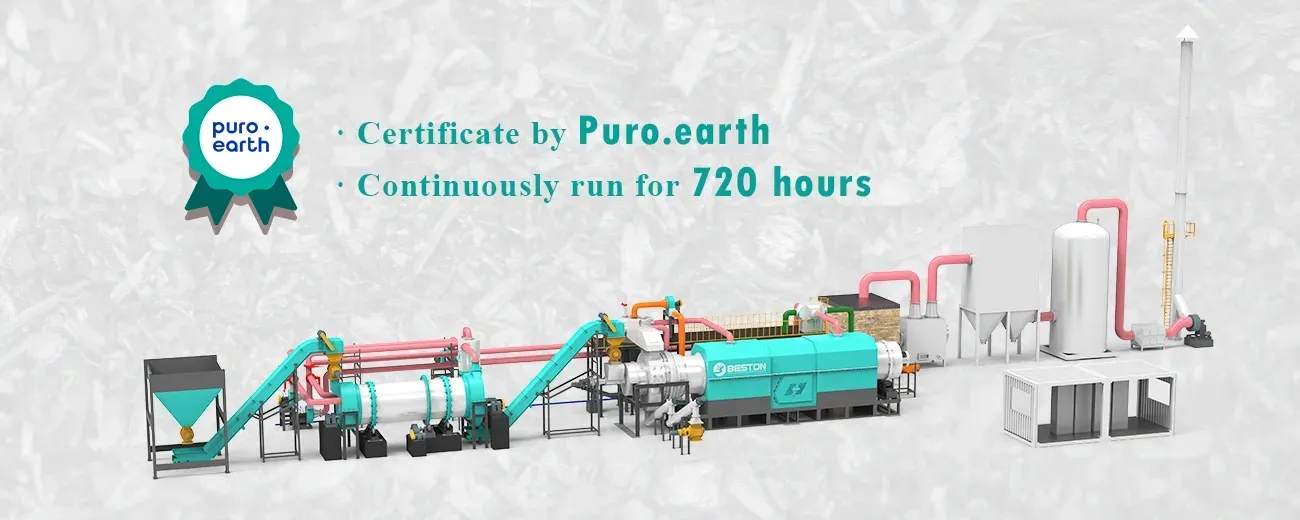

Innovative Machinery

Recent advancements in technology have improved the efficiency and performance of coconut shell charcoal making machines. Key innovations include:

- Automated Systems: Automation and control systems streamline the production process, ensuring consistent quality and reducing labor costs. These systems also enable precise monitoring and adjustment of process parameters.

- Enhanced Efficiency: Modern machines are designed to maximize energy efficiency and reduce emissions. Features such as energy recovery systems and advanced filtration technologies contribute to lower operational costs and improved environmental performance.

Research and Development

Ongoing research and development in the field of charcoal production continue to drive improvements in machinery and processes. Innovations in material science and engineering contribute to the development of more efficient and cost-effective machines, further enhancing the investment potential.

Risk Factors

Market Fluctuations

Investors should be aware of potential market fluctuations that may impact the profitability of coconut shell charcoal production:

- Raw Material Availability: Variations in the availability of coconut shells can affect production consistency. Developing reliable supply chains and diversifying sources can mitigate this risk.

- Price Volatility: The prices of coconut shell charcoal can fluctuate based on market demand and competition. Implementing flexible pricing strategies and maintaining market intelligence can help manage price volatility.

Regulatory Compliance

Adhering to environmental and safety regulations is crucial for the success of a coconut shell charcoal making venture. Compliance with local and international standards requires investment in quality control and monitoring systems. Staying informed about regulatory changes and maintaining compliance can prevent legal issues and operational disruptions.

Conclusion

The investment potential of a coconut shell charcoal making machine is substantial, driven by growing market demand, economic advantages, and environmental benefits. With low raw material costs, efficient production processes, and high return on investment, these machines offer an attractive opportunity for investors. Technological advancements and sustainability benefits further enhance their appeal. By carefully assessing market conditions, managing risks, and ensuring regulatory compliance, investors can capitalize on the opportunities presented by coconut shell charcoal production.